Free Local Classified Ads

Buy & sell with ease on Pakistan's fast growing online marketplace We manage your 1000 ads for 1000 days

- Home

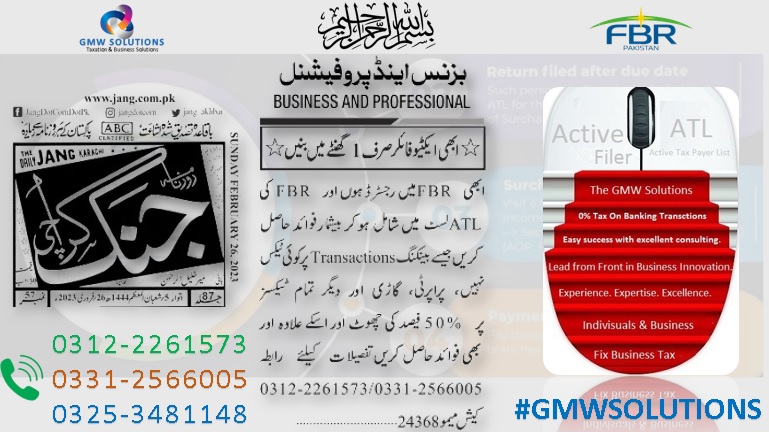

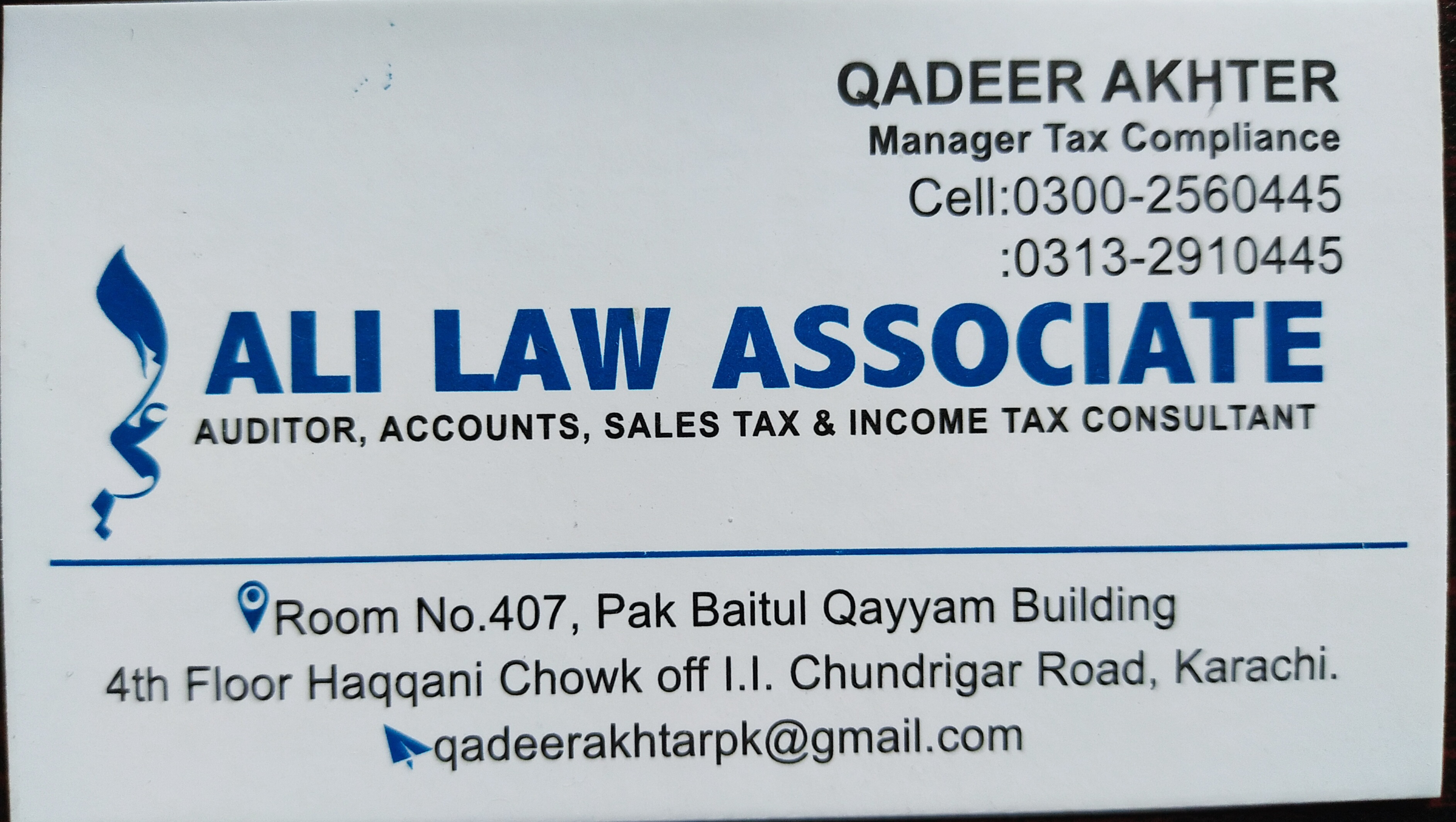

- Sales Tax Monthly Returns, Registration and All Corporate Tax Services

Sales Tax Monthly Returns, Registration and All Corporate Tax Services

Contact Seller

Rs

1,000

- phone_number

- 03126027231

DESCRIPTION

Assalam O Alaikum, Important Notification for All Sales Tax, Corporate Tax, GST and SRB Registered Clients. Above Mentions All Categories Clients Must Be Complete, their Sales Tax Monthly filing before 10th of Every Month. Because After Due Date FBR Impose Heavy Penalty as Per Sales Tax Ordinance 2001. Per Day Penalty of Rupees Ten Thousands. Also Late Filing Causes. Mostly FBR or SRB Suspends or Blacklist Your Sales Tax Account. Also FBR or SRB, Take Strictly Legal Actions against Persons or Companies Who Not Properly Filing of Sales Tax. In Actions Includes Minimum Lacs of Rupees Penalties, Seizing Bank Account and Assets And Many More. So Remember before 10th Every Month; File your Sales tax Returns with Pay Taxes on time. Note: For Sales Tax Registration, DE Registration, Monthly Returns, Principal Activity Changing, Sales Tax Exemptions, Sales Tax Refunds and All Sales Tax Matters, Feel Free To Contact “GMW Solutions” 24 Hours Online With High Experienced Professionals Free Advisory. Hotline 24/7/365 Online. Call or Whatsapp 0312. 2261. 573 Or 0331. 2566. 005 Or 0325. 3481. 148 Google Us #GMWSOLUTIONS Our Profile Link: https://goo.gl/maps/Kn3A2bGXcawsQmVx6 #GMWSOLUTIONS Thanks and Warm Regards.-

Published

2023-03-06 17:52:14

-

Ad Id

28387

-

Category

Services

Leave a Review

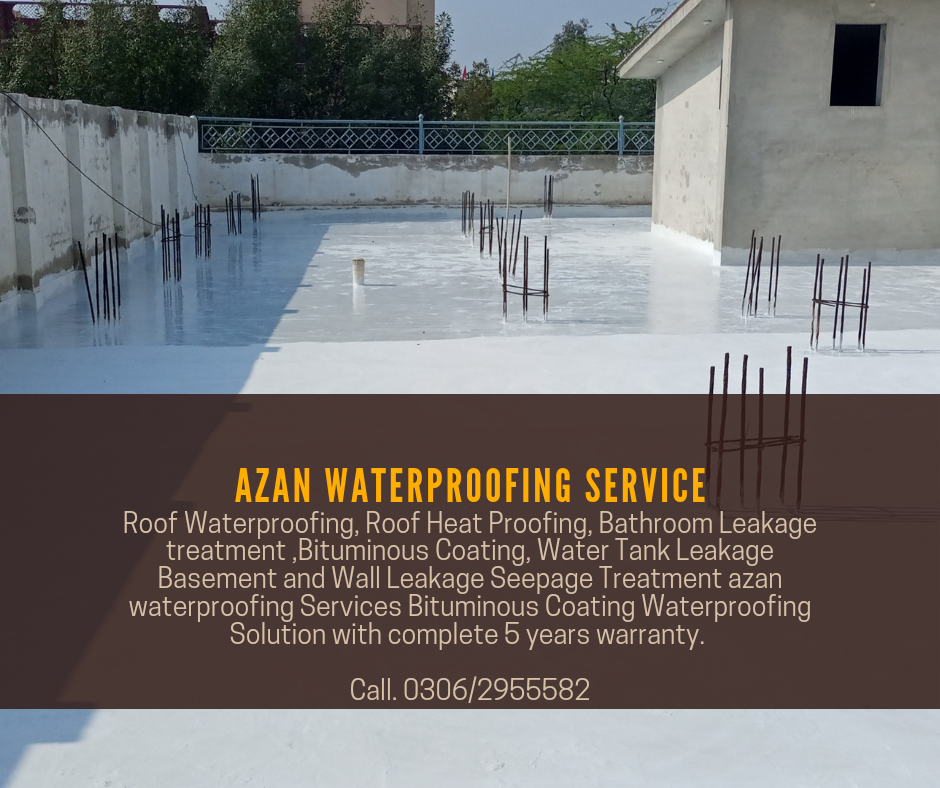

Roofer waterproofing company, Roof waterproofing & Heat proofing services in Pakistan.

- 2021-07-08 17:52:10

Rs

40

Book Professional & Experienced Certified AC Technician Now in Karachi with Bulao. PK

- 2022-04-06 03:23:58

Rs

75,300

rs 1000 rs 1000 amilo k amil baba sona masih for services - other services">Amilo k amil baba sona masih

- 2022-04-21 00:54:05

Rs

1000

Rs

1,000

Pick High-Level King Air Ambulance Service in Nagpur with Medical Tool

- 2022-05-16 16:22:27

Rs

350,000

SSD CHEMICAL, ACTIVATION POWDER and MACHINE available FOR BULK cleaning! WhatsApp or Call:+919582553320

- 2022-06-06 11:33:40

2,000

% Off

ASLI AMIL BABA BANGALI KALA JADU KALA ILAM EXPERT IN KARACHI LAHORE ISLAMABAD,UK

- 2023-01-21 05:28:29

Rs

700

.Amil baba in lahore,bangali baba in karachi, black magic specialist in canada

- 2023-01-24 13:51:26

700

Manpasand Shadi Uk, Talaq Ka Msla, Amil Baba Karachi Kala Jadu Black Magic

- 2023-01-31 00:38:27

700

% Off

Manpasand Shadi Uk, Talaq Ka Msla, Amil Baba Karachi Kala Jadu Black Magic

- 2023-01-31 00:39:37

Rs

700

ASLI AMIL BABA BANGALI KALA JADU KALA ILAM EXPERT IN KARACHI LAHORE ISLAMABAD,UK

- 2023-07-15 08:41:00

Rs

700

rs 1099 rs 999 hitachi repair service 0300 921 4332 for services - electronics repair services">Hitachi Repair Service 0300 921 4332

- 2023-08-24 12:14:16

Rs

1099

Rs

999

Trinity Hemp Spinny 6G Disposable Vape Price In Pakistan - 03001597100

- 2025-02-07 08:05:27

Rs

14,999

03126027231

Safety information

- This site is never involved in any transaction, and does not handle payments, shipping, guarantee transactions, provide escrow services, or offer "buyer protection" or "seller certification".

- Make yourself aware of common scams and fraud.

- When buying or selling, you should meet in-person to see the product at a safe location. Never send or wire money to sellers.

- Don't accept cashier cheques from outside your country.

We have a gift for you! Use this code to get a discount.

Contact buyer Login

Posting ads is faster and easier with Topdeals

_副本.jpg)

.png)

.png)

.jpg)

.jpg)

.jpeg)

340240090_970852017240675_2953163602815798114_n.jpg)

340241272_908439720422855_7901532008258581881_n.jpg)

340236093_2490920174406992_8795104207079170020_n.jpg)

340394557_900825057815601_4329145708256561789_n.jpg)

340237463_230910932940018_7353826413042012875_n.jpg)

340434175_169349616016105_880946039163458812_n.jpg)

.png)

.png)

.png)

.png)

.png)

.jfif)

.jpg)

.png)

.jpeg)

_副本.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

340240090_970852017240675_2953163602815798114_n.jpg)

340394557_900825057815601_4329145708256561789_n.jpg)

340240090_970852017240675_2953163602815798114_n.jpg)

340237463_230910932940018_7353826413042012875_n.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpeg)

.jpeg)

.png)

.png)

.jpg)

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.jpg)

.jpeg)

.jpeg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Reviews